June

While there has been ample commentary in the press regarding the well-founded challenges that are facing owners of office buildings – particularly those located in central business districts (“CBD”) – much of the commentary has painted the environment with too broad a brush. The truth is that there is a bifurcated scenario wherein office buildings that are newer, higher-quality and have new and attractive amenities are winning tenants at the expense of older lower-quality office buildings, which are the most at risk of losing existing employers as they seek to provide their employees with a higher quality of work life in the new era of hybrid work models.

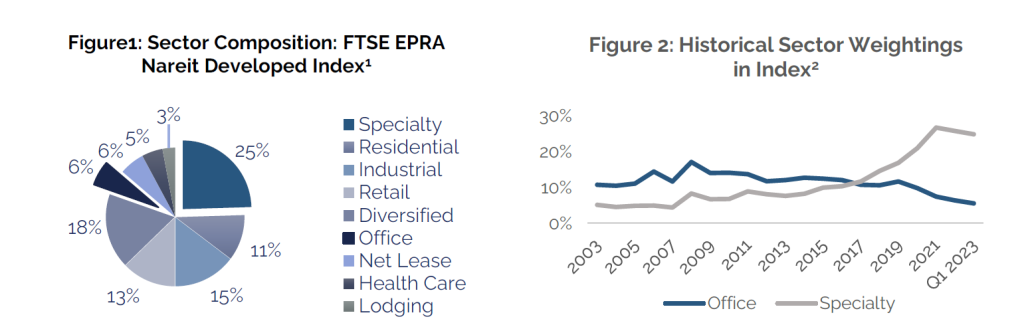

The office sector makes up only 6% of the market value across the listed real estate universe in the U.S (Figure 1). The office sector’s weight in the benchmark has been diminishing over time, supplanted in part by the growth in non-traditional specialty property types, which are characterized by a disequilibrium of supply and demand which leads to higher growth prospects (Figure 2). Some examples of these property types include data centers, cell towers, student housing, single-family rental homes, medical office buildings, cold storage facilities and life science/lab space.

The office sector is experiencing extraordinary challenges due to fundamental and secular changes in how companies manage their office space needs in the new paradigm of hybrid work. Excluding class A CBD properties with attractive amenity packages, we believe that the owners of most office buildings will experience significant headwinds for at least the next five years as existing leases expire and tenants downsize their space requirements. The Easterly Global Real Estate Fund (JARIX) is currently positioned on a risk-aware basis, with awareness of the challenges that office building owners are facing with very low overall exposure to this sector. The office companies that we own each have differentiated portfolios and business models that substantially mitigate their exposure to the risks and challenges facing other companies. A good example is a company which leases 100% of their space to U.S. federal government agencies, whose employees engage in work that typically requires in-office presence, thus making hybrid work models generally unavailable.

1 Source: FactSet as of March 31, 2023.

2 Historical weighting within the FTSE EPRA Nareit Developed Index from December 31, 2002 through March 31, 2023. See Glossary for additional information.

About the Author:

Andrew J. Duffy is a Managing Partner, Chief Investment Officer and Senior Portfolio Manager of Ranger Global Real Estate Advisors. Andrew has over 30 years of experience as an investor in global real estate securities. He has been the Senior Portfolio Manager of the Easterly Global Real Estate Fund (“JARIX”) since its inception in 2009. From 2009 to 2016, he was the President of Ascent Investment Advisors, LLC.

Prior to 2009, Andrew was a Managing Director with Citigroup Principal Strategies, where he established and managed the proprietary liquid global real estate investment business which included a long-short portfolio of global real estate securities. Previously, he was the Co-Portfolio Manager of the Hunter Global Real Estate Fund, and from 1999 until 2006, a Portfolio Manager at TIAA-CREF, where he established the liquid global real estate investment business and team, ultimately managing over $3.5 billion in global real estate equity and debt securities. Between 1993 and 1999, he was a Senior Research Analyst at Eagle Asset Management, where he launched and managed a dedicated real estate securities investment program with responsibility for fundamental analysis, securities selection and portfolio construction. Prior to that, Andrew served as a Partner at Raymond James & Associates where, as an investment banker he managed public offerings and advised on mergers and acquisitions.

Andrew received a Bachelor of Science from the United States Military Academy at West Point in 1979 as a Distinguished Graduate, and a Master of Business Administration degree from the Harvard Business School in 1986. He earned his Chartered Financial Analyst designation in 1995.

Glossary:

Core Real Estate: Ranger Global defines Core as property types that are more highly correlated to GDP growth and typically fall into Office, Industrial, Retail, and Multi-Family Property types.

Specialty Real Estate: Ranger Global defines Specialty as a disparate group of non-core property types which typically exhibit a number of distinctive investment characteristics:

- Specialty property types generally operate in an environment of favorable supply-demand dynamics, conveying superior pricing power to landlords;

- Specialty property types typically generate higher growth rates than core property types;

- Demand for Specialty property types is generally a product of idiosyncratic demand drivers that are un-correlated to GDP growth

Examples of Specialty property types include: Data Centers, Cell Towers, Student Housing, Medical Office, Self-Storage, Manufactured Home Communities, Timber, Outdoor Advertising, Single-Family Rental, Life Science/Lab Space, Leisure and Infrastructure. The universe of Specialty real estate companies is expanding quickly and constantly evolving.

FTSE EPRA Nareit Developed Index: an Index comprised of publicly‐traded real estate securities in developed countries worldwide which have met certain financial criteria for inclusion in the Index. Each company must derive the bulk of its earnings through the ownership, management or development of income‐producing commercial real estate.

Mutual funds involve risk, including possible loss of principal. Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund. This and other information is contained in the Fund’s prospectus, which can be obtained by calling 888.814.8180 and should be read carefully before investing.

Important Fund Risks

Past performance is not a guarantee nor a reliable indicator of future results. As with any investment, there are risks. There is no assurance that any portfolio will achieve its investment objective. Mutual funds involve risk, including possible loss of principal. The Easterly Funds are distributed by Ultimus Fund Distributors, LLC. Easterly Funds, LLC and Ranger Global Real Estate Advisors, LLC are not affiliated with Ultimus Fund Distributors, LLC, member FINRA/SIPC. Certain associates of Easterly Funds, LLC are securities registered with FDX Capital LLC, member FINRA/SIPC.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in one particular sector. Risks of one’s ownership are similar to those associated with direct ownership of real estate, such as changes in real estate values, interest rates, cash flow of underlying real estate assets, supply and demand and the creditworthiness of the issuer. International investing poses special risks, including currency fluctuations and economic and

political risks not found in investments that are solely domestic. Options involve risk and are not suitable for all investors. Writing a covered call option allows the Fund to receive a premium (income) for giving the right to a third party to purchase shares that the Fund owns in a given company at a set price for a certain period of time. There is no guarantee of success for any options strategy. Increased portfolio turnover may result in higher brokerage commissions, dealer mark-ups and other transaction costs and may result in taxable capital gains. Investments in lesser-known, small and medium capitalization companies may be more vulnerable to these and other risks than larger, more established organizations.

Easterly Funds, LLC serves as the Advisor to the Easterly Funds family of mutual funds and related portfolios. Their form ADV can be found at www.adviserinfo.sec.gov. Please consider the charges, risks, expenses and investment objectives carefully before investing. Please see prospectus, or if available, a summary prospectus containing this and other important information. Read it carefully before you invest or send money. Mutual Funds are distributed by Ultimus Fund Distributors, LLC. Member FINRA/SIPC.

As with any investment, there are multiple risks associated with REITs. Risks include declines from deteriorating economic conditions, changes in the value of the underlying property and defaults by borrowers, to name a few. Please see the prospectus for a full disclosure of all risks and fees.

THE OPINIONS STATED HEREIN ARE THAT OF THE AUTHOR AND ARE NOT REPRESENTATIVE OF THE COMPANY. NOTHING WRITTEN IN THIS COMMENTARY OR WHITE PAPER SHOULD BE CONSTRUED AS FACT, PREDICTION OF FUTURE PERFORMANCE OR RESULTS, OR A SOLICITATION TO INVEST IN ANY SECURITY.

17065927-UFD 06/28/2023