Through 2023 and into 2024, values of private commercial real estate have increasingly become more distressed. The total of this distressed value is approaching $100 billion according to MSCI Mortgage Debt Intelligence in the charts depicted below (Exhibits A and B). Most of the distress is centered in office properties, followed by retail, hotel, and apartments.

| Exhibit A | Exhibit B |

|

|

| Source: https://www.msci.com/www/quick-take/us-commercial-property-distress/04355163707, as of 1/30/2024 | |

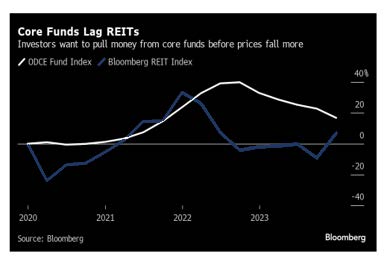

Given appraisal-based (backward looking) valuation methodologies of real estate assets by private owners (i.e., banks, private equity, pension funds), privately held real estate price declines have thus far been limited and have materially lagged when compared to the price declines seen in listed real estate securities. As noted in Exhibit C, publicly listed securities valuation appears to have bottomed, while private real estate prices are continuing their decline.

| Exhibit C |

|

| Source: Bloomberg as of February 22, 2024 |

Lesson from the Global Financial Crisis? REITs win, while commercial real estate distress peaks:

There will be hand wringing about the commercial real estate distress situation currently, to be sure. A day doesn’t pass where we don’t read about the woes facing commercial real estate in the Wall Street Journal or hear about it on CNBC. But history suggests that REITs have often appreciated during periods of rapidly rising private real estate distress.

As seen in Exhibit A, during the Global Financial Crisis, commercial real estate distress peaked in 2011 at nearly $200B. Contrary to what most observers might expect, from 2009 to 2011 U.S. REITs delivered a positive 81% total return. How is this divergent performance possible?

Listed real estate is forward looking:

Listed real estate securities are priced daily by market forces. In real time, investors discount the future into equity market price valuations. The public markets foresaw the coming distress in commercial real estate during 2008 and repriced listed real estate lower very quickly. During 2008, U.S. REITs declined 37%. This price correction positioned listed real estate to outperform private real estate from 2009 forward, when privately held real estate had yet to be re-priced.

REITS: Real Estate In trouble becomes Real Estate In transition:

Over the two years between 2009-2010, U.S. REITs raised over $81 billion of new equity capital as investors saw attractive buying opportunities arising from distressed private owners of real estate assets. In fact, during this period there were nine REIT IPOs that came to market. The answer to distress is, most often, recapitalization via new equity, and REITs have historically been the market’s solution to access this new equity.

At the start of 2011, the President and CEO of NAREIT, Steven Weschsler, put it best when he said, “In a commercial real estate marketplace in which many private owners have continued to find it difficult to raise capital to restructure highly leveraged balance sheets, REITs again demonstrated their cost-effective access to capital through the public markets.”

We would expect to see a similar transition of assets from distressed private sellers to REITs as the current economic situation unfolds. The global market is clearly in the early stages of such a transition with a little over $5 billion of new equity raised by globally-listed REITs over the past seven months.

REITs benefited more quickly from declining cost of capital:

The 81% increase in valuation from 2009-2011 provided U.S. REITs with an attractive cost of equity capital which was superior to their private equity counterparts, many of whom were dealing with legacy asset divestments. Further, the Federal Reserve rapidly decreased rates over this period, credit spread tightened as real estate fundamentals recovered, and REIT balance sheets improved. The current environment appears similar to 2009, with potential for the Federal Reserve to reduce rates in the future. Additionally, we are seeing early-stage primary equity issuance and improving real estate fundamentals for most asset types.

Commercial real estate distress is real for banks and private equity.

Outsized returns in real estate investments are often generated by investing at the bottom of a cycle and purchasing quality assets from motivated sellers. We saw this dynamic play out over 2009-2011, which led to a windfall for many of the higher-quality REITs. Although we don’t have perfect clarity, we see many similarities currently to what transpired in the last real estate cycle.

Glossary

Bloomberg REIT Index: An Index comprised of publicly‐traded real estate securities in the United States which have met certain financial criteria for inclusion in the Index. Each company must derive the bulk of its earnings through the ownership, management, or development of income‐producing commercial real estate.

ODCE Fund Index:. The NFI-ODCE, short for NCREIF Fund Index – Open End Diversified Core Equity, is an index of investment returns reporting on both a historical and current basis the results of open-end real estate commingled funds aimed at enhancing the transparency of the non-listed real estate investment industry pursuing a core investment strategy.

Disclosures

Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed may be worth more or less than their original cost. Investors cannot invest directly into an index. For performance information current to the most recent month-end, please call 888-814-8180. Material must be preceded or accompanied by a current prospectus.

Securities offered through Easterly Securities LLC, member FINRA/SIPC.

IMPORTANT FUND RISK

Risks of real estate fund ownership are similar to those associated with direct ownership of real estate, such as changes in real estate values, interest rates, cash flow of underlying real estate assets, supply and demand and the creditworthiness of the issuer. International investing poses special risks, including currency fluctuations and economic and political risks not found in investments that are solely domestic. Options involve risk and are not suitable for all investors. Writing a covered call option allows the Fund to receive a premium (income) for giving the right to a third party to purchase shares that the Fund owns in a given company at a set price for a certain period of time. There is no guarantee of success for any options strategy. Increased portfolio turnover may result in higher brokerage commissions, dealermark-ups and other transaction costs and may result in taxable capital gains. Investments in lesser-known, small and medium capitalization companies may be more vulnerable to these and other risks than larger, more established organizations.

Past performance is not a guarantee nor a reliable indicator of future results. As with any investment, there are risks. There is no assurance that any portfolio will achieve its investment objective. The portfolio is subject to stock market risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an investment. Risks of one’s ownership are similar to those associated with direct ownership of real estate, such as changes in real estate values, interest rates, cash flow of underlying real estate assets, supply and demand and the creditworthiness of the issuer. International investing poses special risks, including currency fluctuations and economic and political risks not found in investments that are solely domestic.

THE OPINIONS STATED HEREIN ARE THAT OF THE AUTHOR AND ARE NOT REPRESENTATIVE OF THE COMPANY. NOTHING WRITTEN IN THIS COMMENTARY SHOULD BE CONSTRUED AS FACT, PREDICTION OF FUTURE PERFORMANCE OR RESULTS, OR A SOLICITATION TO INVEST IN ANY SECURITY.

20240509-3555717