Institutional Real Estate Allocations are Evolving

Over the last several years, we believe sophisticated institutional investors have increasingly begun to appreciate the benefits of complementing their private real estate portfolios with strategic, long-term allocations to listed real estate. In our opinion, portfolio expansion into the public markets has allowed for broader sector and geographic diversification and has enhanced real estate portfolios’ ESG attributes by owning leading performers. This represents a change in investment strategy for many institutions, including some of the world’s largest sovereign wealth funds and endowments, whose portfolios have historically sought exposure to real estate primarily through the private markets. (Source: FactSet.)

We believe that the trend of combining both private and listed real estate exposure is being driven by investor recognition of four primary factors:

1. Innovation and Growth in Specialty Property Types

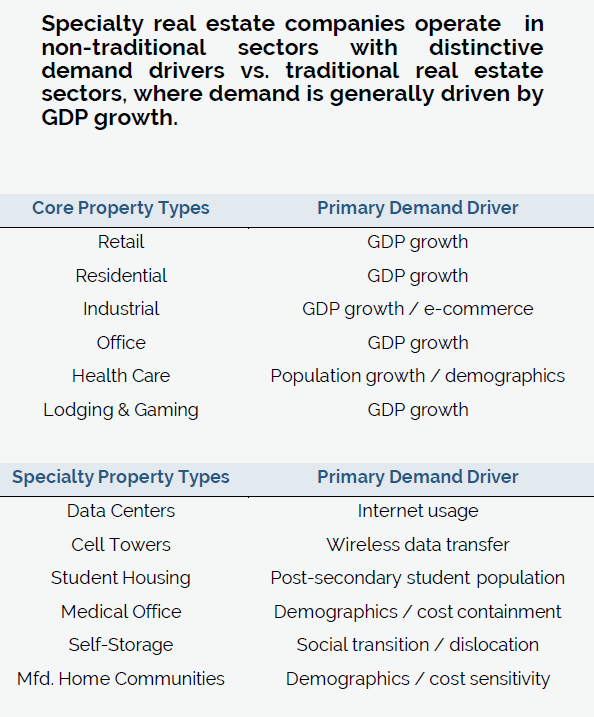

During the last decade, the commercial real estate market has evolved to include a variety of innovative, non-traditional property types, many of which have been driven by advances in technology, demographic shifts and societal changes. Such Specialty real estate companies tend to operate in sectors where demand typically outpaces supply. Specialty property types are characterized by distinctive demand drivers which may generate higher growth and attractive returns when compared to traditional property types.1

Further, we believe that the COVID-19 pandemic accelerated interest in Specialty property types, while tempering interest in sectors such as office buildings and regional malls. The state of the office sector has dramatically changed given the current market environment and the impact of the pandemic on employees’ work locations and routines. Likewise, the retail sector continues to be disrupted by the rapid expansion of e-commerce. As a result, there has been increasing attention to alternative property types for which some of these trends provide significant tailwinds.

Specialty Real Estate: Differentiated Demand

1 Source: FactSet. Data shown represents the period December 31, 2015 through December 31, 2022, during which time the Specialty sector of the FTSE EPRA Nareit Developed Index generated a total return of 53.2% vs. the non-Specialty (or, “Core”) property sectors of the index, which generated a return of 10.4%.

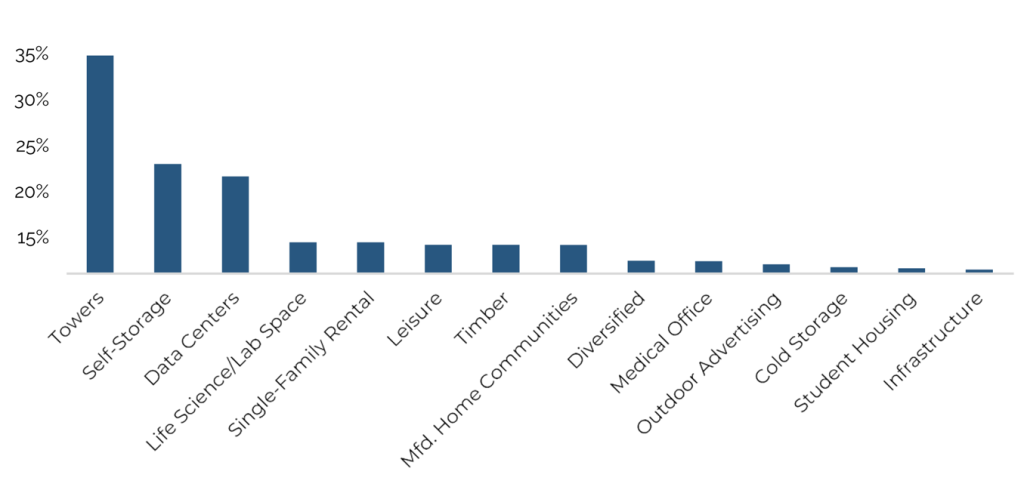

The emergence of the Specialty investable universe, which includes property types such as data centers, cell towers, medical office buildings, cold storage warehouses, single-family rental homes and life science/lab space, has occurred primarily in the publicly-traded real estate market, and we expect to see these sectors continue to gain traction with investors.

As an example, cell towers, a property type that is particularly capital-intensive, are available to investors largely through the listed market, and have represented a compelling investment opportunity in recent years. For the five-year period ended December 31, 2022, the Towers sub-sector of the FTSE Nareit All Equity REITs Index generated a total return of 59.4%.2

What Makes Up the Specialty Opportunity Set3

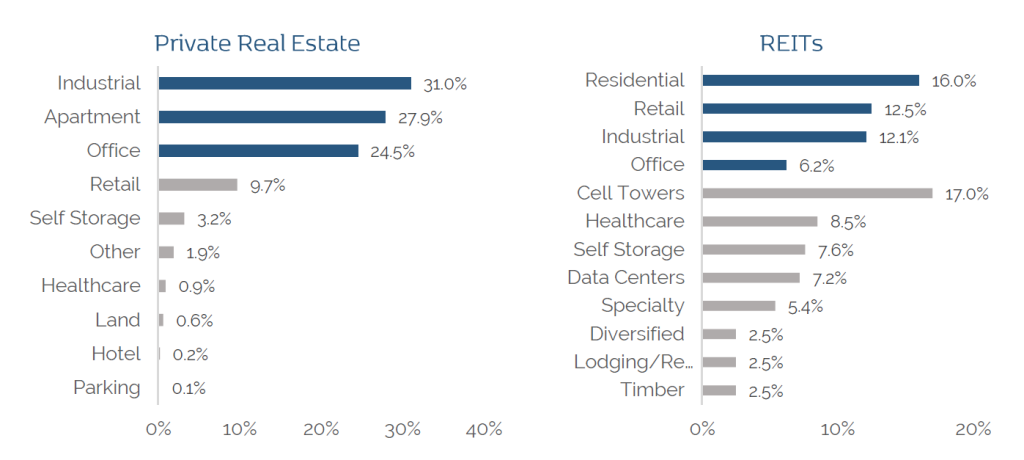

While there has been some recent growth in the availability of Specialty investment opportunities in the private real estate markets, the vast majority of the investable Specialty universe still exists in the listed, putting private-only real estate investors at a disadvantage in accessing this diverse, quickly-evolving opportunity set of higher-growth property types.

2Source: FactSet. As of December 31, 2022.

3Source: FactSet, as of December 31, 2022. Data reflects Ranger Global’s investable universe of Specialty companies on a market-cap weighted basis.

The publicly-traded Specialty investable universe is comprised of a variety of innovative and growing group of property types, many of which have been driven by advances in technology, demographic shifts, and societal changes, generally operating in an environment of favorable supply-demand dynamics.

Property Sector Diversification4

4Source: Nareit, Open End Diversified Core Equity ending market value as of Q22022 via NCREIF. FTSE Nareit All Equity Index, equity market capitalization as of June 30, 2022via FactSet.

2. Public/Private Arbitrage Opportunities

While the returns on all commercial real estate investments, whether held in a private or publicly-traded portfolio, are driven by real estate fundamentals and have demonstrated a strong correlation to one another over time, differences in how and when real estate is valued create arbitrage opportunities for savvy investors.

In contrast to publicly-traded real estate, which is valued daily by the market and thus immediately prices in changes in fundamentals, private real estate is valued through backward-looking appraisals on an infrequent basis – at a delay when compared to the real-time data incorporated into publicly-traded real estate prices.

This lag in price discovery by the private market can offer investors several advantages when combining public and private real estate in their portfolios, including:

- Portfolio diversification benefits – Each real estate property type operates within its particular context of supply and demand, resulting in different economic outcomes, e.g., their investment returns as well as their correlation to other property types. Thus, adding exposure to Specialty property types may enhance the overall portfolio’s return characteristics and can potentially lead to higher risk-adjusted returns.

- Informational advantages – Listed real estate’s ability to reflect new information into pricing on a real-time basis can help offer private investors directional guidance on the potential investment opportunities and the possible trajectory of private real estate returns.

- Pricing dislocation opportunities – Given its equity wrapper, listed real estate prices may at times react negatively to exogenous, non-fundamental market conditions, creating transitory periods when listed real estate companies may trade at discounts to their net asset values until changes in market conditions and/or sentiment result in a return to parity (or even a premium) to their private market values. Also, during these periods of pricing dislocation, listed real estate companies can become the target of M&A, which may create compelling investment returns for shareholders.

3. Attractive Investment Characteristics

Listed real estate exhibits several attractive investment characteristics that have become increasingly favored by investors in recent years, including:

- Daily liquidity, allowing for straightforward and timely adjustments to portfolio exposure, thereby providing the ability to deploy or access capital with greater speed and efficiency

- Diverse exposure across geographies and sectors, offering the ability to hold thousands of assets in a single portfolio

- Attractive income, as REITs are required to pay out a large percentage of their free cash flows to investors in the form of dividends

- Comprehensive management teams with strong corporate governance practices and industry-leading environmental and social policies

- Strong balance sheets with access to capital in both public and private markets, thereby maximizing financial flexibility with a lower cost of capital

- Transparency, driven by regulatory disclosures and market oversight

- Demonstrated commitment to innovative and impactful ESG practices and disclosure, holding leadership accountable for measurable performance in line with evolving stakeholder expectations

4. Highly-Aligned Interests Can Drive Shareholder Value Creation

Insider ownership of listed real estate companies is notably high, aligning management’s interests with those of shareholders via significant skin in the game. By structuring additional equity in the company as a substantial component of executive compensation, listed real estate companies can further incentivize management teams to boost stock prices and grow dividends for investors.

Further, publicly-traded real estate companies continue to enhance their commitment to ESG and DEI initiatives, accountability and disclosure. In a review of industry-level ESG performance, NAREIT surveyed its public real estate membership with results showing positive trends in stewardship and resilience, with 82% of the companies surveyed reporting the integration of ESG risks and opportunities into their strategy in 2021 and 90% mandating oversight of ESG at the board level. Further, 83 of the largest 100 REITs owned green-certified buildings, and 80 of the largest 100 REITs produced standalone sustainability reports in 2021.5

5 Source: Nareit REIT Industry ESG Report 2022, as of 12/31/2022

Conclusion: Advantages of Specialty Property Types

Some advantages of Specialty property type investors include:

- A well-diversified approach to optimize exposure to Specialty property types while investing across the market capitalization spectrum

- Provides investors with the benefits of higher-growth niche property types which are more challenging to access in private markets

- Ability to deploy capital quickly and efficiently across Specialty sectors in liquid markets, in contrast to the limited set of skilled Specialty operators sponsoring private investment vehicles in this sector

- Ability to opportunistically capitalize on market dislocation otherwise unavailable to private real estate investors

- Low correlation of returns of Specialty property types to traditional, core property types may reduce total portfolio volatility

While there has been some recent growth in the availability of Specialty investment opportunities in the private real estate markets, the vast majority of the investable Specialty universe still exists in the listed market, putting private-only real estate investors at a disadvantage in accessing this diverse, quickly-evolving opportunity set of higher-growth property types.

By complementing a predominantly traditional public or private real estate portfolio with digital infrastructure and other non-traditional real estate exposure through the Specialty property types it offers investors the opportunity to complete their real estate allocations and gain access to some of the most compelling real estate investment opportunities available – those property types driven by strong secular trends, including the digitalization of commerce, the increasing need for data storage and transmission and shifts in global demographics.

Despite the heightened volatility of the public equity market over the past year, we believe there is a compelling case for investing in listed real estate and particularly Specialty property types, predicated on:

- Valuations of Specialty property types have adjusted to the market’s re-pricing of higher growth/longer duration assets and are currently trading at prices below their historical net asset value, creating an attractive entry point for long-term investors

- As the U.S. Fed and other major central banks seek to rein in inflation by slowing the global economy, higher growth will most likely become more valuable and companies that can deliver it will be seen as more desirable by investors

- Listed real estate companies have maintained strong balance sheets, which may put them in good position for 2023 and beyond, with historically low leverage and well-termed, well-structured debt

Mutual funds involve risk, including possible loss of principal. Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund. This and other information is contained in the Fund’s prospectus, which can be obtained by calling 888.814.8180 and should be read carefully before investing.

Important Fund Risks

Past performance is not a guarantee nor a reliable indicator of future results. As with any investment, there are risks. There is no assurance that any portfolio will achieve its investment objective. Mutual funds involve risk, including possible loss of principal. The Easterly Funds are distributed by Ultimus Fund Distributors, LLC. Easterly Funds, LLC and Ranger Global Real Estate Advisors, LLC are not affiliated with Ultimus Fund Distributors, LLC, member FINRA/SIPC. Certain associates of Easterly Funds, LLC are securities registered with FDX Capital LLC, member FINRA/SIPC.

There is no assurance that the portfolio will achieve its investment objective. The Fund is subject to stock market risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an investment. Risks of one’s ownership are similar to those associated with direct ownership of real estate, such as changes in real estate values, interest rates, cash flow of underlying real estate assets, supply and demand and the creditworthiness of the issuer. International investing poses special risks, including currency fluctuations and economic and political risks not found in investments that are solely domestic. Incorporating alternative investments into a portfolio presents the opportunity for significant losses including in some cases, losses which exceed the principal amount invested. Also, some alternative investments have experienced periods of extreme volatility and in general, are not suitable for all investors. Asset allocation and diversification strategies do not ensure profit or protect against loss in declining markets.

Easterly Funds, LLC serves as the Advisor to the Easterly Funds family of mutual funds and related portfolios. Their form ADV can be found at www.adviserinfo.sec.gov. Please consider the charges, risks, expenses and investment objectives carefully before investing. Please see prospectus, or if available, a summary prospectus containing this and other important information. Read it carefully before you invest or send money. Mutual Funds are distributed by Ultimus Fund Distributors, LLC. Member FINRA/SIPC.

As with any investment, there are multiple risks associated with REITs. Risks include declines from deteriorating economic conditions, changes in the value of the underlying property and defaults by borrowers, to name a few. Please see the prospectus for a full disclosure of all risks and fees.

THE OPINIONS STATED HEREIN ARE THAT OF THE AUTHOR AND ARE NOT REPRESENTATIVE OF THE COMPANY. NOTHING WRITTEN IN THIS COMMENTARY OR WHITE PAPER SHOULD BE CONSTRUED AS FACT, PREDICTION OF FUTURE PERFORMANCE OR RESULTS, OR A SOLICITATION TO INVEST IN ANY SECURITY.

17029715-UFD 06/22/2023