Bear Market Background

Listed global real estate experienced a significant 2-year bear market from the beginning of 2022 through most of 2023, with a total return decline of 32%.1 This bear market was caused by a combination of factors, including rising interest rates, widening credit spreads, deteriorating operating fundamentals, declining valuations and a capital markets freeze. However, from the bear market low on October 25, 2023, through the end of 2023, global real estate securities (represented by the FTSE EPRA/NAREIT Global Real Estate Index) appreciated 22%. This suggests the possibility of the beginning of a new bull market, despite the recent pullback in early 2024. Perhaps this is the case, but it remains to be seen whether or not investors come to see this as a sustainable move higher.

Is this a Shift From “Doom Loop” to “Virtuous Cycle”?

At the October 2023 low, value investors saw attractive entry points in the then-current REIT prices. Additionally, many REIT investors believed that the worst was likely over. Investor mindset in December 2023 was influenced by:

- Most major central banks across the globe were indicating that the cycle of interest rate tightening was nearing completion, after having raised interest rates on average approximately 500 bps.2

- The U.S. Federal Reserve was considering pausing their two plus years of quantitative tightening and investors suspected the possibility of multiple rate cuts in 2024.

- In most developed countries, inflation had peaked and was declining quickly due to the lagged effects of tight global monetary policy and the re-opening of supply chains.

- Bank failures in the U.S. were being viewed as more company-specific and less structural in nature.

- Most global economies would emerge from 2023 in shallow recessions and/or experience modest growth.

Are We in the Early Stages of a Recovery?

It is important to understand that the market move that listed global real estate experienced at the end of 2023 is potentially yet another rally in an ongoing bear market. That said, it could also be seen (in hindsight) as the beginning of a bull market. For reference, REIT bull markets have historically lasted for multiple years. In fact, the last four global listed real estate bull markets lasted, on average, 6.4 years with a total average return of 228% and a CAGR of 22%3.

The early stages of a bull market are typically characterized by improving operating fundamentals, as evidenced by growing rents, expanding margins, and growing net asset values. According to UBS, earnings per share growth for global real estate companies is expected to expand from 3.8% in 2024 to 6.7% in 20254. Further, UBS estimates that global real estate securities are currently priced at an average 12% discount to net asset value (NAV), making high-quality commercial real estate substantially cheaper in the public market than it is in the private market.

These nascent improvements in operating fundamentals, coupled with the recent unfreezing of capital markets, increase the likelihood of NAV per share growth from both net operating income improvements and potential cap rate compression.

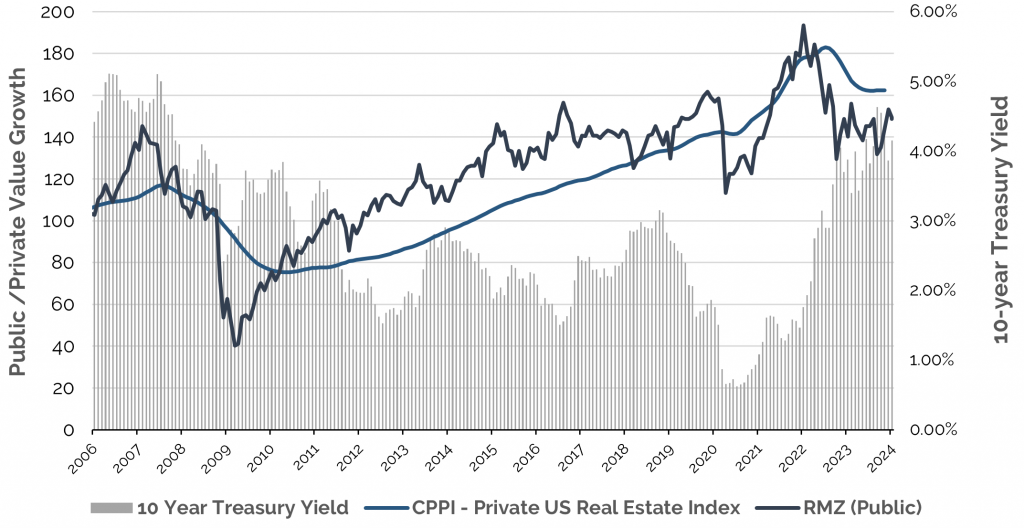

Note: The data utilized reflects U.S. private and public real estate only. U.S. REITs comprise approximately 50% of the global market. Source: Bloomberg, Ranger Global Real Estate Advisors, NCREIF as of 1/25/2024.

Listed Real Estate Leadership

It is true that listed real estate has historically led private market valuations due to the lag in private market appraisal-based valuations compared to publicly-listed real estate’s daily pricing. Today, we may be at the point of the cycle where listed real estate will lead private real estate higher.

Although the chart on the previous page is focused on the relationship between private and public real estate valuations in the U.S. markets, we believe that the same data holds true in global markets

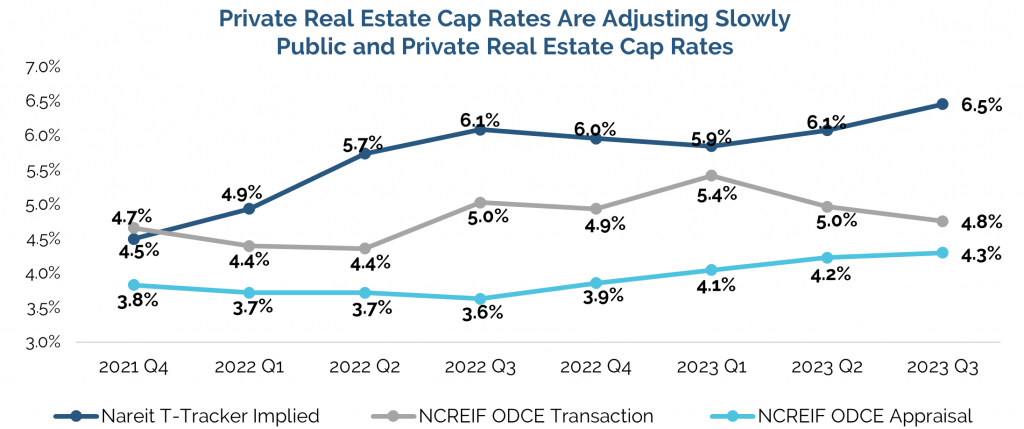

Private Real Estate Owners Behind the Markdown Curve

Private real estate owners have been slow to adjust the value of their real estate assets downwards during the most recent market downturn, in contrast to the immediate repricing that occurs in the listed real estate markets. The following chart illustrates this lag with greater implied capitalization rates for listed real estate when compared to private real estate.

Source: Nareit, Ranger Global Real Estate Advisors, NCREIF as of 9/30/2023.

While implied capitalization rates for listed real estate companies decline with stock price appreciation, the lagged private market capitalization rates begin to expand to catch up with the more realistic cap rates of public companies. As a result, listed real estate companies trading at NAV premiums become the logical buyers of direct real estate sold by private equity and other direct real estate investors, oftentimes at very attractive valuations.

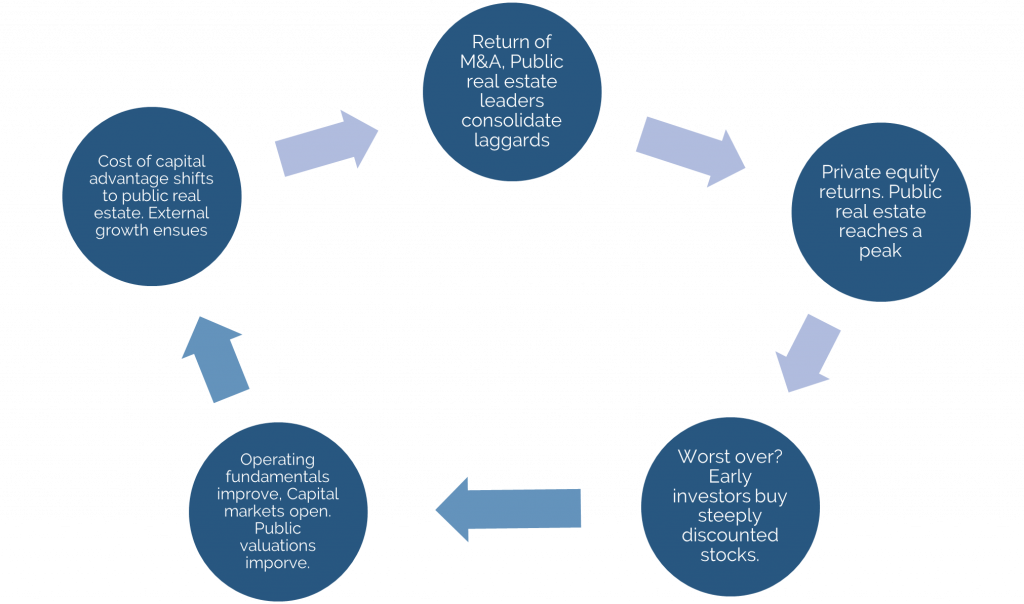

Next Stage of Listed Global Real Estate Bull Market – Laggards Catch Up

As more capital is attracted to listed real estate, fund flows begin to turn positive, and valuations continue to improve. The underperforming real estate companies may begin to receive M&A premiums as these companies are increasingly viewed as takeover targets. As of December 31, 2023, 80% of global listed real estate securities trade at NAV discounts.5

Listed Real Estate Cycle in Picture (6.4 Year Historic Average Cycle)

For illustrative purposes only. Source: Ranger Global Real Estate Advisors and Bloomberg. Index used is FTSE EPRA Nareit Developed Index.

Global Real Estate Bull Market Likely Not Synchronized

Real estate and capital market cycles differ across the globe and the “Equity Growth Story” will likely appear over various time periods in different countries. As such, a publicly-traded global real estate portfolio is well-positioned to participate in these equity growth stories as they arise in different markets. Already there have been a number of equity offerings in the U.S., Canada, Europe, UK, Japan and Singapore, which suggests the possibility of incremental capital raising there, and elsewhere around the world, as 2024 unfolds. A strong active REIT manager with a solid long-term track record has the ability to create a global portfolio that can opportunistically take advantage of these pricing dislocations around the world as they present themselves.

Are the Conditions Right for a REIT Bull Market?

For a listed real estate bull market to truly begin, management teams must recognize their cost of capital advantage, and execute upon value-additive external growth. Additionally, capital markets must continue to remain open and with interest rates which are accretive to the growth story. Finally, exogenous shocks to global markets must prove to be transitory. We are cautiously optimistic that there is potential for M&A expansion in 2024-2025 and we could be witnessing the initial stages of a global listed real estate bull market.

1 Source: Bloomberg, Ranger Global Real Estate Advisors. Index used FTSE EPRA Nareit Developed Index, 12/31/23

2 Source: Bloomberg, FactSet, 12/31/23

3 Source: Bloomberg, FactSet, 12/31/23

4 Source: UBS, Global Valuation Report, 12/31/23

5 Source: UBS, Global Valuation Report, 12/31/23

About the Author

Todd A. Voigt, CFA© is a Portfolio Manager focusing on the selection and management of international holdings at Ranger Global Real Estate Advisors, subadvisor of the Easterly Global Real Estate Fund. Mr. Voigt has more than 28 years of experience in the global real estate securities industry. From 2014 through 2016, he served as the Portfolio Manager for a long-short real estate fund at WMD Asset Management. Previously, he spent six years at Cohen & Steers Capital Management, where he served as the Portfolio Manager for multiple global real estate securities hedge funds and UCITS, and eleven years at Cliffwood Partners, where his responsibilities included portfolio management and stock selection for global real estate securities hedge fund strategies and the short side of a 120/20 strategy.

Mr. Voigt graduated from Claremont McKenna College in 1995 with dual degrees in Mathematics and Economics. He earned the Chartered Financial Analyst designation in 2001.

Glossary

Core Real Estate: Ranger Global defines Core as property types that are more highly correlated to GDP growth and typically fall into Office, Industrial, Retail, and Multi-Family Property types.

Specialty Real Estate: Ranger Global defines Specialty as a disparate group of non-core property types which typically exhibit a number of distinctive investment characteristics:

- Specialty property types generally operate in an environment of favorable supply-demand dynamics, conveying superior pricing power to landlords;

- Specialty property types typically generate higher growth rates than core property types;

- Demand for Specialty property types is generally a product of idiosyncratic demand drivers that are un-correlated to GDP growth

Examples of Specialty property types include Data Centers, Cell Towers, Student Housing, Medical Office, Self-Storage, Manufactured Home Communities, Timber, Outdoor Advertising, Single-Family Rental, Life Science/Lab Space, Leisure and Infrastructure. The universe of Specialty real estate companies is expanding quickly and constantly evolving.

FTSE Nareit All Equity REITs Index: an Index that contains all publicly traded U.S. REITs. The FTSE Nareit All REITs Index is not free float adjusted, and constituents are not required to meet minimum size, liquidity, or minimum voting right criteria.

Risks & Disclosures

Past performance is not a guarantee nor a reliable indicator of future results. As with any investment, there are risks. There is no assurance that any portfolio will achieve its investment objective. Mutual funds involve risk, including possible loss of principal. The Easterly mutual funds are distributed by Easterly Securities LLC. Easterly Investment Partners, LLC and EAB Risk Solutions, LLC are affiliates of Easterly Securities LLC, member FINRA/SIPC. Orange Investment Advisors, LLC and Ranger Global Advisers are not affiliated with Easterly Securities LLC.

There is no assurance that the portfolio will achieve its investment objective. The Fund is subject to stock market risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an investment. Risks of one’s ownership are similar to those associated with direct ownership of real estate, such as changes in real estate values, interest rates, cash flow of underlying real estate assets, supply and demand and the creditworthiness of the issuer. International investing poses special risks, including currency fluctuations and economic and political risks not found in investments that are solely domestic. Incorporating alternative investments into a portfolio presents the opportunity for significant losses including in some cases, losses which exceed the principal amount invested. Also, some alternative investments have experienced periods of extreme volatility and in general, are not suitable for all investors. Asset allocation and diversification strategies do not ensure profit or protect against loss in declining markets.

Easterly Investment Partners serves as the adviser to the Easterly family of mutual funds and related portfolios. Easterly Investment Partners is registered as an investment adviser with the SEC. The Easterly mutual funds are distributed by Easterly Securities LLC. Although Easterly Investment Partners is a registered investment adviser, registration itself does not imply and should not be interpreted to imply any particular level of skill or training.

As with any investment, there are multiple risks associated with REITs. Risks include declines from deteriorating economic conditions, changes in the value of the underlying property and defaults by borrowers, to name a few. Please see the prospectus for a full disclosure of all risks and fees.

THE OPINIONS STATED HEREIN ARE THAT OF THE AUTHOR AND ARE NOT REPRESENTATIVE OF THE COMPANY. NOTHING WRITTEN IN THIS COMMENTARY SHOULD BE CONSTRUED AS FACT, PREDICTION OF FUTURE PERFORMANCE OR RESULTS, OR A SOLICITATION TO INVEST IN ANY SECURITY.

20240326-3447176